Top 3: MakerDAO becomes a landlord | Optimism token valuation | $GMI didn't make it

Top 3 topics for the week of 1/7/23: MakerDAO's real estate play | Optimism token valuation | GMI ain't gonna make it

Dear frontrunners,

In this week’s “top 3 topics”, we review:

Real-world assets by exploring MakerDAO’s foray into commercial real estate

Optimism’s token valuation & upcoming unlock

A post-mortem on the GMI token: it didn’t make it

For the many new subscribers to Frontrun, “top 3 topics” is our weekly piece where we review three topics and include links to other impactful research reports, newsletters, and crypto forecasts of value.

Before we start, a special thank you for the support & momentum Frontrun has recently experienced. I saw a Frontrun article trending on the first page of the Ethereum subreddit and was pleasantly surprised to see it was the piece on “How to take self-custody of your crypto with a multi-sig wallet”. No hot takes, no investment ideas. Just good ole’ security & self-sovereignty.

If you’re still holding crypto on a centralized exchange, I encourage you to take steps toward self-custody in 2023.

To knowledge and wisdom,

John Cook

January 7th, 2023

San Francisco, CA

www.frontruncrypto.com

1. MakerDAO's real estate play

There’s been a re-emergence of the “real world asset” (RWA) narrative within the Ethereum crypto ecosystem: On-chain loans used to fund off-chain investments. Off-chain investments mean deploying capital to purchase risk-free assets like US Treasury Bonds, finance accounts receivable loans, fund real estate investment projects, or even invest in unsecured debt used to finance smartphone purchases for consumers in 3rd world countries. My suspicion is the renewed interest was fueled by last month’s launch of rwa.xyz: analytics on real-world assets.

Call out: If you need a refresher on real-world assets, how its tokenized on-chain, or associated risks, review this analysis first.

What piqued my interest was the “real estate” section on rwa.xyz which led me to this tweet. Is MakerDAO investing in real estate? If so, how? and how much? and with whose money?

MakerDAO is partnering with BlockTower to fund a $220m loan via Centrifuge. This means:

MakerDAO is a lender: $150m senior loan

BlockTower is a lender: $70m junior loan

BlockTower is also the asset manager and loan originator for prospective borrowers

Centrifuge is the DeFi protocol that facilitates the on-chain tokenization of the RWA

More information can be found in this MakerDAO proposal, but the TLDR is MakerDAO deploys its $150m of DAI into a series of Centrifuge loan vaults managed by BlockTower. BlockTower provides 30% junior capital in every vault from its LPs and also acts as the loan originator for prospective BlockTower borrowers, extending credit to “qualified and accredited investors” to facilitate real-world investments, across one of four asset categories:

This is a departure from how Maker normally mints DAI, traditionally overcollateralized by Ethereum. Unfortunately, over-collateralization is now bad in this era of crypto because over-collateralization = inefficient use of capital, remember? 🪦

Reading through the documentation I was a bit suspicious, granted I am not a member of Maker’s finance committee and authority on how it soft pegs to the US Dollar, but Maker has $5.96 billion in total value locked and it is the largest collateralized debt protocol on Ethereum.

A risk with Maker & real-world assets is the possibility that a default may persist due to bad off-chain investments made by distant loan originators to borrowers acquiring assets Maker has no insight into or specialization in assessing. If this happens & real-world-assets is not adequately liquidated to cover the obligation:

Maker may have to absorb the bad debt via its Maker Buffer (currently $250m).

If not enough Dai exists in the Maker Buffer, new MKR tokens may be minted, which would increase the amount of MKR in circulation, and may cause downward pressure on its existing spot price.

Sounds pretty risky for an extra 1% in yield. Apparently many members of the Maker DAO share this opinion:

Have we learned nothing from FTX et al.? Why are we risking Maker’s solvency on these B-grade centralized opaque assets when we can just put it in treasuries and earn solid yields on the massive free capital we’ve accumulated?

… and just to be clear BlockTower seems like a great organization…My issue is that the DAO simply doesn’t have the expertise to analyze the assets underlying these types of deals. - MakerDAO forum

Voting rights in the MakerDAO are conferred via MKR token holders pro-rata the number of MKR tokens owned…and surprise: MKR ownership is skewed such that a few individuals control an outsized supply, either by direct token ownership or delegation.

It should be no surprise that this snapshot vote passed: 75% Yes, 15% No, 10% abstain. How? The ten largest MKR voters accounted for 74% of the aggregate voting power.

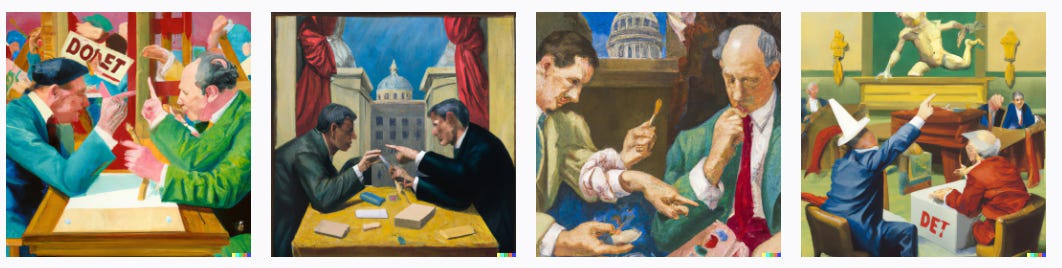

So much for decentralization? Either way, given MakerDAO has ~$6.5 billion of assets under management of which approximately $850 million are “real world assets”…

….when we break down the $850m by RWA classification, we can begin to extrapolate what % of the loans are used to facilitate capital investments in real property versus government bonds and/or commercial paper. My best guess is around ~$125m of the $850m allocated to RWA represents real property:

RWA007 = $500m used to purchase US government bonds

RWA009 = $100m loan to Huntingdon Valley Bank

RWA001 = $14.4m loan 6s capital for purchase agreements on O'Reilly Auto Parts, Service King, Wawa, Tesla

RWA002 = $11.3 million loan to New Silver as hard money loans for real estate investors

…you can see additional details in this Dune analytics report, but isn’t it a little wild that Maker’s collateralized debt pools are being used to finance commercial real estate deals for O’Reilly Auto Parts?

It gets better, the $100 million loan issued to Huntingdon Valley Bank is a tradfi bank located in Philidelphia. Its terms of the agreement included an initial debt ceiling of $100 million with a target goal of $1 billion in 12 months to facilitate commercial loans, construction financing & loans guaranteed by property, plant or equipment:

What I find interesting is how Maker is calculating is “value locked on-chain”. How are the assets associated with a Wawa or Service King on-chain? With NFTs of course! Lenders like Centrifuge are minting “DROP” and “TIN” NFTs that represent real-world collateral and its associated yield.

The Asset Originators commit to repaying holders of two types of tokens related to the vault, the DROP and TIN tokens. These represent senior and junior tranches of the loan, respectively, and offer a different type of risk/reward ratio for holders. DROP holders are first in line and have the value of their loan backed by TIN holders, who represent the junior tranche. DROP holders receive a comparatively lower interest rate in exchange for this guarantee, while TIN holders can obtain higher returns at the cost of higher risk. - Centrifuge

So why does any of this matter? Why does it matter that an online asset manager with ~$7B AUM is allocating $850m to real-world assets of which $125m are secured by real property?

Because Maker is not an asset management firm. Maker is not Blackrock, The Vanguard Group, Fidelity Investments, or any other asset management firm that exists to maximize shareholder value by efficiently deploying capital that yields the highest return on assets.

Maker was created to address the public’s growing frustration and distrust of dysfunctional financial systems.

Maker’s core product is Dai: a stablecoin pegged to the US Dollar

The Dai stablecoin is engineered to minimize price volatility

Dai’s value is its stability. These are the first principles outlined in Maker’s whitepaper.

Underwriting traditional finance loans to commercial institutions collateralized by real property is the antithesis of “price volatility minimization”. It violates Maker’s promise to solve dysfunctional financial systems & enables the same bad practices that caused the last financial crisis.

Most importantly, it puts the entire crypto ecosystem at risk by exposing centralization and off-chain opaque investment risks to Ethereum’s largest stablecoin. Real estate is not risk-free and Maker should take heed to this warning: $7b of AUM with a $250m default buffer is not sufficient. Should widespread contagion circa the 2008 real estate crisis reemerge in 2023+, Maker’s position as defi’s stablecoin of choice will be jeopardized.

2. Optimism’s token value & investor unlocks

Before we discuss Optimism’s (OP) tokenomics, unlock schedule & valuation I want to be clear in stating that my criticism of a protocol’s tokenomics and/or price does not mean I’m not a believer in its technology & potential to impact the broader crypto ecosystem. A lot of tokens in the crypto space are just overvalued, and OP is one of them.

OP is an Ethereum L2 protocol designed with a modular framework that enables developers to engineer a flexible roll-up architecture across its consensus, execution & settlement layers. Below is a great thread summarizing OP’s value prop, check it out:

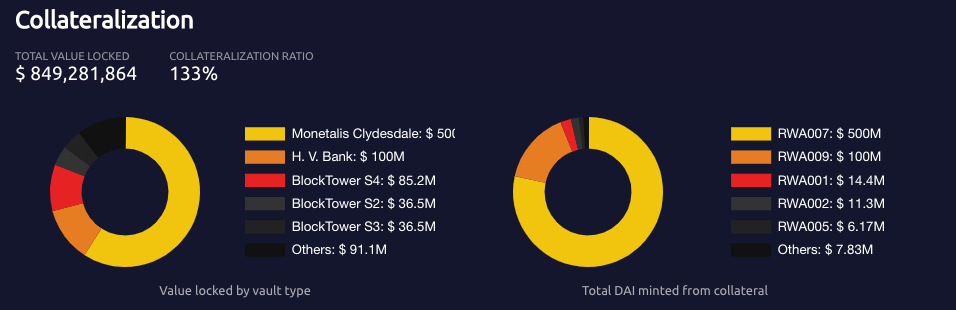

But what about the money? OP is ranked #9 in protocol total value locked. It has a fully diluted market cap of $4.6 billion at $1.08/token and is of course 100% pre-sold:

Lots of slices in the “category” act as an illusionary hand wave of equal distribution but when you read between the lines, it’s another centralized pre-sold wealth creation event for the few at the expense of the many: 81% (total - user airdrops) of the token is under the control of Optimism and/or its investors.

Retroactive public goods (RetroPGF) funding sounds noble, and in a way, it may be the best aspect of OP’s tokenomics. Around ~860m OP tokens will be allocated to RetroPGF to: “adequately and reliably reward public goods for the impact they provide”. A governing committee consisting of the Optimism Collective, Citizens House, and Token House will be responsible for doling out OP tokens as grants to projects:

That has been deemed to provide substantial public good along certain criteria

and compensate project builders for their positive contributions without generating direct revenue

I encourage everyone to learn more about RetroPGF by clicking here.

So what is the fair market value of an OP token? Is it $1.08? $2.06? $100? We can start by asking “What is the net profit of an optimism transaction after paying for base layer security? This is called “sequencer margin” and is calculated as:

Sequencer Fee Margin: L2 Transaction Fees - L1 Batch Submission Fees

L1 Batch Submission Fees: L1 Fees that the Optimism protocol pays to submit L2 transactions to L1 (also referred to as L1 Security Fees or Security Costs).

L2 Transaction Fees: Fees that users pay on L2 Optimism to submit transactions.

OP’s 30-day average daily sequencer fee margin is ~$14,559 with a high of ~$45,000. At least the protocol is profitable. Good. But is it worth $4b, $10b, or $100m?

If we accept the [$14,000, $45,000] as the base case range for daily sequencer fees, annualize across a 12-month rolling window & assume there will be no token inflation (which we know not to be true but let’s keep it simple):

A fully diluted market cap yields earnings per token [EPT] between $0.001-$0.003, and at the current spot price of $1.08, OP is trading between 270x-865x P/E.

This is saying that an investor is “willing to pay between $269 and $865 for every dollar of earnings”. Private investors are not buying at this price, they are selling. A $4b market cap is too high & I am betting the farm that investors are going to dump OP as soon as their vesting schedule allows them to do so.

OP’s daily sequencer fee margin will have to 10x its current $14,000/daily earnings to justify the $4 billion market cap. The protocol hasn’t been successful in driving mass adoption without its inflationary liquidity mining incentives.

For example, Optimism has a token incentive program with Aave: Provide collateral on OP’s Aave (and not Arbitrium), then OP will reward you with an additional 2% yield. Borrow funds on OP’s Aave (not Arbitrium) and OP will reward you with a 1% yield rebate. The results?

Increased utilization of Aave during the OP token incentive, and a 99% drawdown at its conclusion:

Within seven days of launch, Aave’s borrowing volume on Optimism increased from $5M to over $1.5B

The borrowing volume decreased $900M to $5M when the program ended

As of December 2022 Aave’s borrowing volume on Optimism is ~$4M

We can see the impact of the OP token incentive on its token price depicted below:

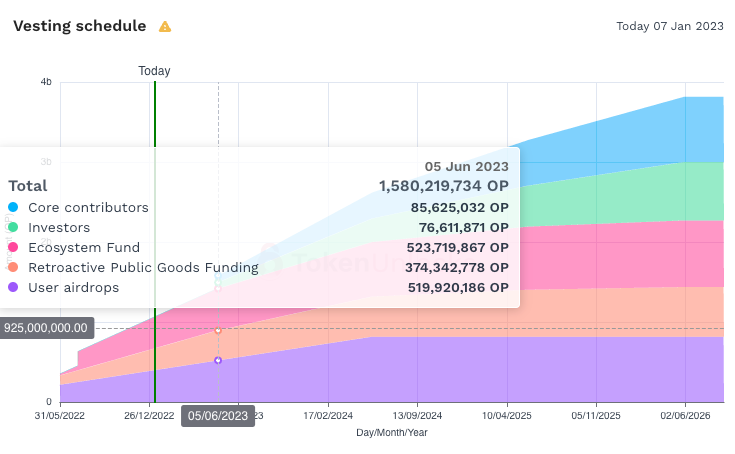

Why am I sharing this? Optimism’s first investor unlock is 142 days away. About 160,000,000 of new OP liquidity will enter the retail market on May 2023.

This 160m distribution has to be considered against:

30% of the [ecosystem, RetroPGF, Airdrops] are available Y1 = 824m

15% of the [ecosystem, RetroPGF, Airdrops] are available Y2 = 412m

10% of the [ecosystem, RetroPGF, Airdrops] are available Y3 = 274m

4% of the [ecosystem, RetroPGF, Airdrops] are available Y4 = 109m

A 2% inflationary schedule

source - Optimism docs

Atleast 1.35b new OP tokens [824m + 120m + 412m] will be available by Y2. Do you really think OP will surpass a $4b market cap given the current macroeconomic headwinds, L2 competition with zkEVM + Arbitrum, and upcoming token unlocks? I don’t. 🪦

DYOR but I am short OP and will write more about this separately.

3. $GMI ain’t gonna make it

Remember GMI? A meme of the last crypto bull cycle that shared the spotlight with notables like: “wen lambo, wen moon, magic internet money, wagmi”, etc. Seems so long ago! GMI eventually became an “on-chain” fund deployed via set protocol. On-chain funds are like ETFs:

They allow users to invest in a basket of crypto assets and employ a variety of strategies without having to handle the tokens individually. In contrast to traditional funds, the on-chain variant does not require a custodian. Instead, the cryptoassets are locked up in a smart contract. The investors never lose control over their funds, can withdraw or liquidate them, and can observe the smart contracts' token balances at any point in time. - Fabian Schar

GMI was the brainchild of the BanklessDAO who envisioned turning the “Bankless DeFi Growth Index” GMI token into a crypto asset that “captures the performance of emergent DeFi application themes" across a set of DeFi apps depicted below:

…GMI has since seen its underlying tokens lose between 95-99% of their aggregate market value.

To participate in this investment, holders also had to pay the set creators (BanklessDAO) a 1.95% management fee, called a “streaming fee”. What’s wild is the capital buy-in requirement for set creators. It’s zero. Not just for BanklessDAO, but for every set creator using TokenSet. This means the individuals creating the set (Indexcoop, Bankless, Galleon, whoever) have no skin in the game. They collect a 2% management fee regardless of the fund’s performance. The result? Disaster.

An 88% draw-down coupled with:

The underlying assets of the GMI index were reallocated to USDC

A proposal to deprecate a basket of crypto assets including GMI

Why? Low TVL, high maintenance, and limited participation:

Over the last several months Index Coop has been scaling back in size and expenditure, and refocusing the product roadmap to meet our core objectives. As part of these ongoing efforts, the Index Coop Product Pod has identified several products that have not shown strong demand or demonstrated product-market fit (PMF). These products have lagged in the metrics and KPIs that Index Coop monitors, metrics such as Total Value Locked (TVL), Net Dollar Flows (N$F), and Unique Holders w/ $100+ in Exposure (UH>$100). - Index Co-op

Please be extremely cautious of investing in any automated crypto asset fund based on an unproven investment thesis with very junior fund operators who have only experienced a bull cycle, smart contract or not. Avoid all “automated asset management” solutions where its creator has zero of their net worth invested in the success or failure of the fund. Without buy-in from the fund manager via their personal capital, you are playing a crooked coin flip: heads they win, tails you lose.

Other content to increase your knowledge and wisdom:

✍️ Frontrun exclusive:

📈 Analysis and research:

Frogs anon: Lending and Borrowing: CeFi Problems and DeFi Solutions

Win, Lose or Recover: Are 2022’s equity losers 2023’s winners?

Decentralized Finance: On Blockchain- and Smart Contract-Based Financial Markets | St. Louis Fed

📊Chart of the week: Crypto liquidity ranking on volume, depth & spread. A useful analysis for evaluating assets beyond its market cap:

Article cover generated by DALL-E: “An abstract oil painting of Norman Rockwell and Michelangelo voting on Maker's next governance proposal”