How to build a ponzi empire with fake money

Do you dream of appearing on billboards, deceiving government regulators, rug-pulling VCs, tricking influencers and robbing retail traders from your love mansion in the Bahamas?

⚠️ Disclaimer - ponzi schemes are illegal, don’t try this at home.

Dear frontrunners,

Does it bother you, or perhaps make you jealous, that a 30-year-old polyamorous, vegan, finance bro can rise from the ashes of obscurity and over the course of 4 years:

Accumulate a net worth of $26 billion dollars

Create $8 billion dollars of fake crypto money

Convince 1 million users to deposit $16 billion dollars into his online crypto trading platform

Persuade The city of Miami to give his company logo rights to the Miami Heat Arena

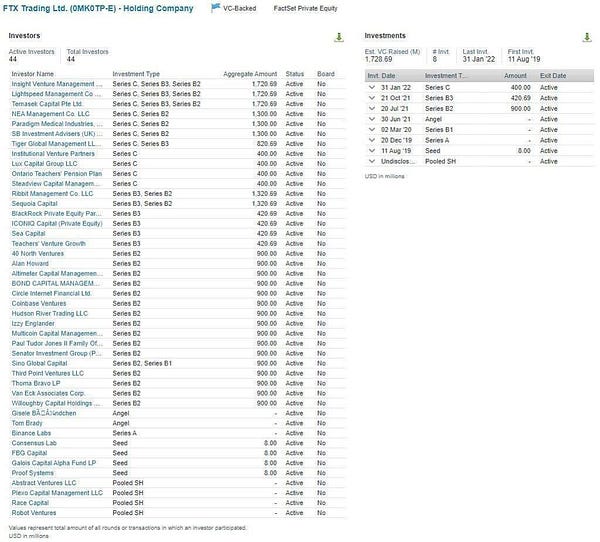

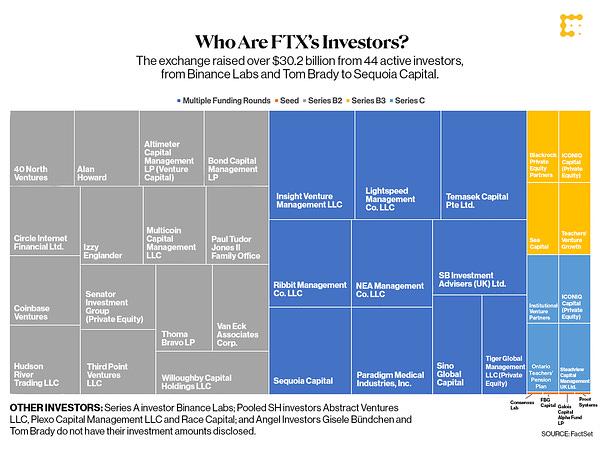

Rugpull the “smart money investment experts” at Blackrock, Sequoia Capital, BlockFi, The Ontario Pension Fund, Temasek Capital, Binance, Softbank, Tiger Global Management, Coinbase Ventures, Paul Tudor Jones, Millenium Management, and many many more out of billions in LP money

sidebar - how is it possible that so much capital was raised and not one investor is on the board?

Deceive Bloomberg, Forbes, CNBC, CNN, and other mainstream media pundits into heralding his company as “the white knight of crypto”

Trick social media influencers, celebrities like Larry David, and crypto leaders into pumping his worthless crypto token to retail traders in the name of effective altruism

Mislead founders and CEOs at companies like Robinhood, Voyager, Messari, Yuga Labs, Circle and many more into taking equity positions in their firms and even relinquishing control of their treasury

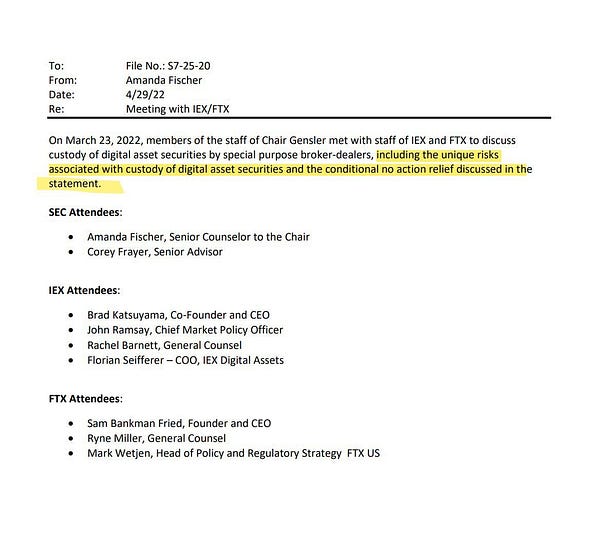

Fool the World Economic Forum, The US Securities and Exchange Commission, The US House Committee on Financial Services, The US Commodity Futures Trading Commission, Bill Clinton, The GOP Republican Party and The DNC Democrats into influencing the financial markets by shaping policy in such a way that it benefits his company and not the broader DeFi ecosystem?

…only to lose it all over the course of 14 days. How is it possible for so many parties, across so many segments of society, to be fooled? The short answer is hubris, greed, and incompetence. The trifecta of failure transcends all participants and its implications should not be waived away under the pretense of “taking risks that sometimes don’t pay off”.

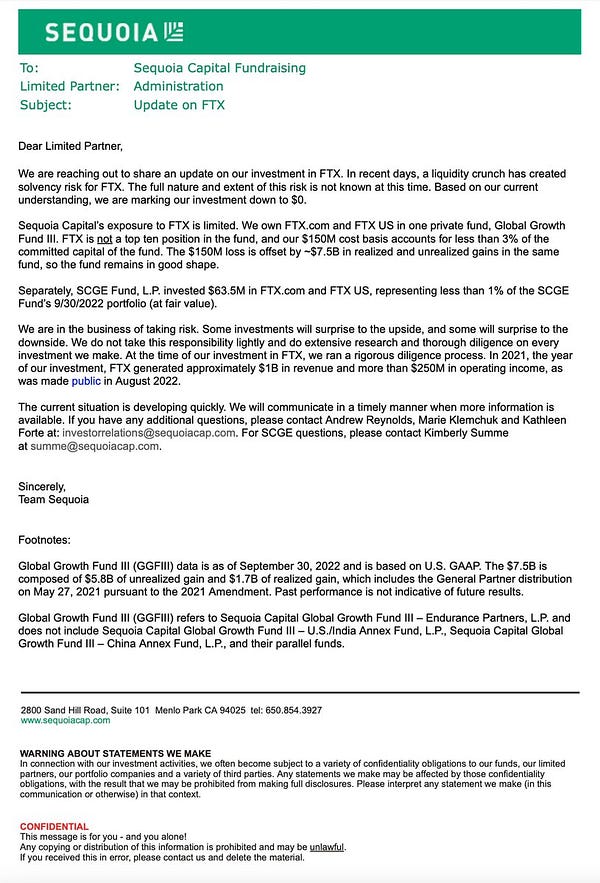

To quote Sequoia Capital:

“We are in the business of taking risks..and some investments will surprise to the downside” - Sequoia Capital letter to LPs on the FTX failure

A “surprise to the downside” is investing in a platform or product that fails to find product-market fit. Failing to identify the Ponzi-inspired business model of FTX vis-a-vis the FTT token is negligence. LPs, taxpayers, and anyone whose capital has been negatively impacted by this disaster should be angry. Talking heads on TV need to resign, government regulators should be embarrassed and forced out of office, and partners at BigVCCo should be held financially responsible. What happened to due diligence? It went out the door because “the number kept going up”.

The rise and fall of FTX has been a fascinating master class in building a Ponzi empire, and with a little bit of grit, determination, and willpower, you can be the Sam Bankman-Fried or Bernie Madoff.

For those looking for a recap of events leading up to the downfall of FTX, I recommend three sources:

“How to steal $16 billion” - Frontrun’s initial analysis on the FTX collapse

“Blockchain Analysis” - a beautiful piece written by Nansen AI outlining on-chain events between Alameda and FTX

“FTX Fall Out” - a 24-minute youtube video documenting the bank run in realtime

Fake money

The first step to Ponzi billions is shilling a product: index universal life insurance, Tupperware, nutritional supplements or crypto tokens. Anything that lacks financial value but confers “privileges” to the purchaser such that aspiring millionaires are duped into buying the product in the hopes of some material appreciation that will never occur.

For FTX, its product and ultimate source of Ponzi contagion, investor hubris, retail greed, and regulator malfeasance is the FTX crypto token called the “FTT Token” (referenced as FTT throughout this writing).

FTX literally created money from thin air.

FTT is a pre-mined crypto token sold to early investors, pumped to retail bag holders, and used as collateral in exchange for US stablecoins. The downfall of the FTT token is that it lacks economic value. Zero revenue earned by FTX is paid to token holders.

To draw a parallel in traditional finance, imagine buying Apple stock without benefiting from Apple’s capital appreciation but instead receiving a 20% discount on all iTunes purchases. Would you pay $150 for a share of AAPL? Would anyone? What do you think the price of that AAPL stock would be? Zero.

This is because the share price of a stock is determined by the firm’s expected future cash flows (google “DCF” if you want more info). It means that the firm’s profits (revenue - expenses) are returned to shareholders via earnings. This is the E (per share) in the “P/E ratio” and its inverse can be used to calculate a share price.

Because zero fees earned by the FTX platform are paid to FTT token holders, the token is literally worthless. The earnings per share of the FTT token is and forever will be $0. This is an important distinction between publically traded companies that are not profitable today but will be tomorrow versus a crypto token that is not profitable today and will never ever be profitable, ever.

FTX marketed the token as an instrument that confers holders certain privileges like:

Discounts on trading fees

Voting rights on FTX token listings

Early access to FTX airdrops

Ability to use FTT as collateral for leveraged and futures positions

The yield earned in bullet point 2 is not a byproduct of any revenue collected; it is a temporary marketing expense paid by FTX to FTT token holders. Back to Apple and its $150 imaginary share price with zero capital appreciation but holders are entitled to 20% off all iTunes purchases. Apple introduces a "5% yield” which pays all holders $7.50 per year. Is the stock now worth $150? The answer is still no. This is true in both the capital and crypto markets.

So how do you think the market, investors, and regulators reacted to a literal worthless shitcoin with fake yield used as collateral to trade futures? With 100% acceptance.

In a 24-month window, the FTT token experienced a 4100% increase from its ~$1.74 ICO price to an at-the-record-high of $73. A pre-mined token with zero revenue and zero trading fees with a fully-diluted market cap of $28 billion dollars.

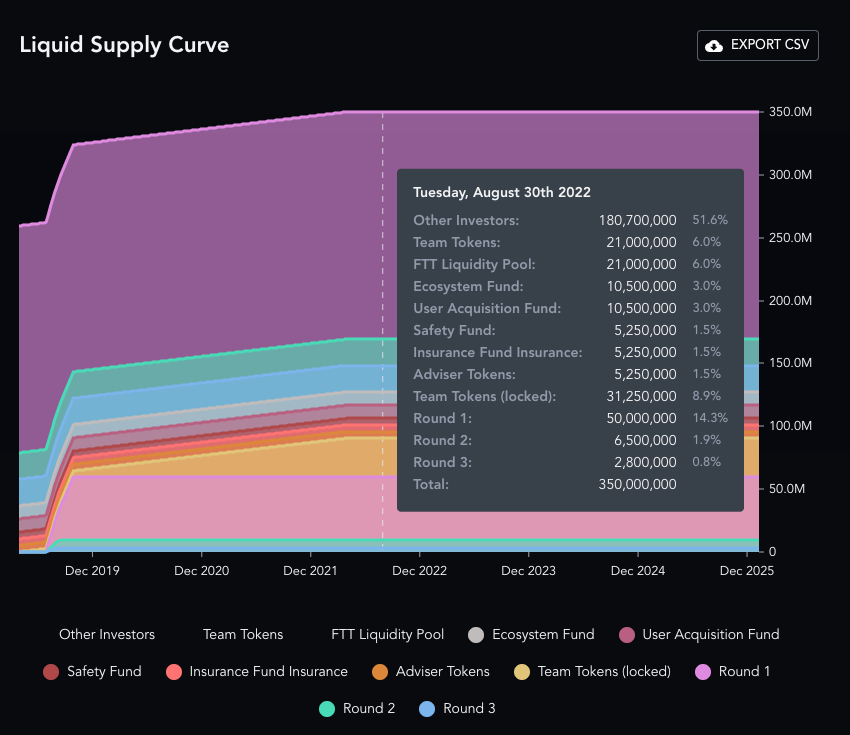

But who were the holders of FTT? FTX investors and early employees. Organizations and individuals incentivized to pump the token or use it as collateral for US dollar-denominated stablecoins. The supply curve depicted by Messari (an FTX portfolio company) paints a confusing picture of the token distribution, attempting to delineate across multiple stakeholders - but per the usual, it’s nothing but smoke and mirrors.

In reality, there are only 2 stakeholders, FTX employees and FTX investors. Approximately 70% of the pre-mined FTT token distribution went to “early investors”, the other 30% went to FTX to fund user acquisition, provide liquidity, and pay early employees.

What’s so amazing about this scam is that FTX is both the product and the investor! Alameda Research, the proprietary investment arm of FTX, connected by SBF, participated in the FTX initial coin offering!

Onchain analysis by Nansen concludes that nearly 280 million FTT tokens, not the 104 million from the official tokenomics supply curve, are controlled by FTX or an FTX subsidiary:

Out of the 350m total supply of FTT, 280m of it was controlled by FTX (~80%). Out of the 59.3m tokens for seed and private rounds…around 27m …ended up on Alameda’s FTX deposit wallet. All of the company tokens (FTT), as well as most unsold non-company tokens, were deposited into a 3-year vesting contract, with an Alameda address as the sole beneficiary. - Nansen AI Blockchain analytics

FTX controlled approximately $22 billion USD of the FTT token. This position is what enabled FTX to:

Buy the support of government officials and acquire other competitors

Fund their global marketing blitz (celebrities like Tom Brady, Steph Curry, Larry David, The Miami Heat arena, etc)

Keep “smart money VCs” at arm’s length with zero desire to analyze the token’s fundamentals

Lend FTT as collateral in exchange for US-denominated stablecoins

FTT is the centerpiece of the Ponzi.

Looking ahead to part 2

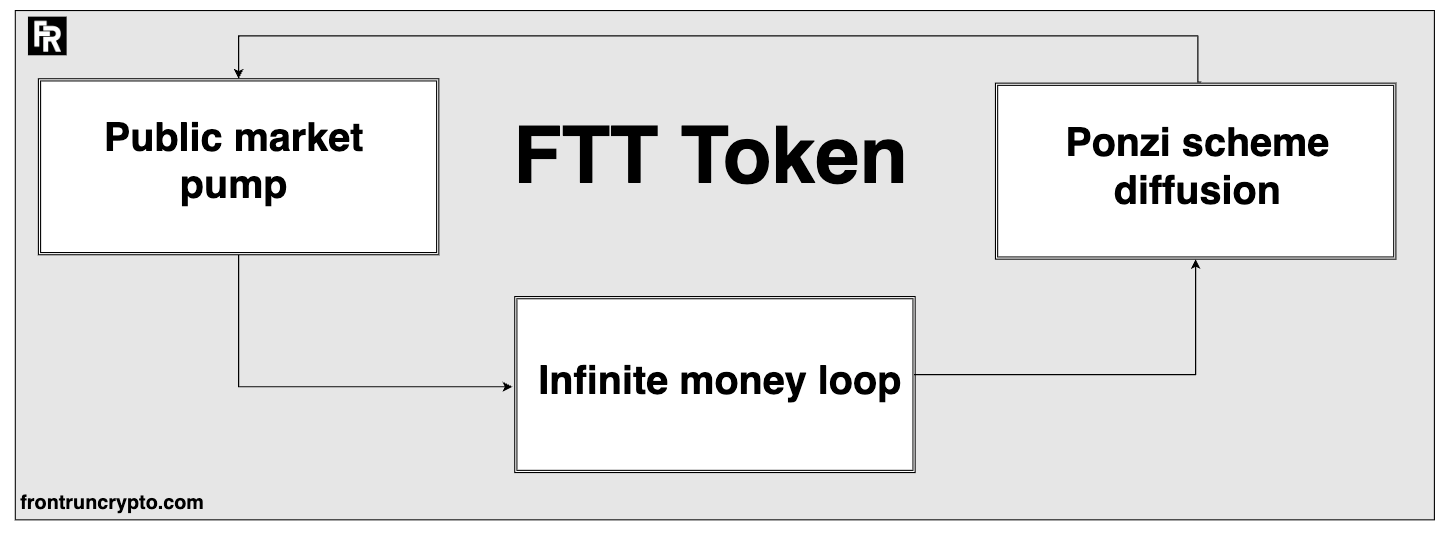

With FTT selected as the pièce de résistance, FTX continued to execute flawlessly across the three stages of Ponzi required to achieve a global rug pull:

Public market pump: convincing retail traders to use FTX and “invest” in FTT

Ponzi scheme diffusion: identifying new retail traders to “invest” in FTT as previous traders capitulate and divest

The infinite money loop: throttling the fake money supply by controlling the stock and flow of the FTT token

We will cover these stages, and the use of SBF’s “effective altruism” marketing campaign as well as his connection to government regulators, in our next issue of Frontrun.

To knowledge and wisdom,

John Cook

San Francisco, CA

November 17th, 2022

www.frontruncrypto.com

Article cover generated by DALL-E: “A Van Gogh style painting of a sunlit indoor lounge area with a clear water pool next to a big window and expensive art for venture capitalists to meet in secrecy”

Picture of the week: Members of the US House Committee on Financial Services standing with the CEO of FTX.

The caption reads, “Don’t worry, these are the people in Congress who are going to get to the bottom of the FTX collapse”.